To ace your preparation for the UPSC, RBI, SEBI, or NABARD exam, you have to stay updated about key economic and regulatory updates. In today’s edition of Vishleshan, we delve into a significant topic: Employment Linked Incentive (ELI) Scheme, Financial Conditions Index (FCI), and Research Development and Innovation (RDI) Scheme. These issues are highly relevant for competitive exams and offer valuable insights into India’s evolving economic scenario. Keep reading to stay ahead with a clear understanding of these current updates.

ALSO CHECK: News Analysis of 1st July 2025

Also, know why RBI Grade B Phase 1 Exam: The Silent Eliminator of 99% Aspirants & What is the Finance and Management Syllabus for RBI Grade B Exam?

Employment Linked Incentive (ELI) Scheme

Context: The employment-linked incentive (ELI) scheme, aimed at generating 35 million jobs in two years, will provide direct financial benefits up to ₹15,000 to 19.2 million first-time employee.

Source: Mint

India has launched the Employment-Linked Incentive (ELI) scheme, a significant initiative designed to stimulate job creation and formalize the workforce. This scheme aims to generate 35 million jobs over two years by providing direct financial benefits to employers for hiring first-time employees. The ELI scheme signals a strategic move by the government to tackle the dual challenges of youth unemployment and informal hiring, aligning with its broader vision for economic growth and decent work.

The ELI Scheme: Primer

The Employment-Linked Incentive (ELI) scheme is a government initiative to incentivize job creation, particularly formal employment for first-time workers.

Facts Related to the Scheme:

- Objective: To generate 35 million jobs in two years.

- Beneficiaries (Employees): Targets 19.2 million first-time employees. These are individuals who register with the Employees’ Provident Fund Organisation (EPFO) for the first time. Employees with annual salaries up to ₹1 lakh are eligible.

- Employer Eligibility: EPFO-registered establishments must hire at least two additional employees (for employers with less than 50 employees) or five additional employees (for employers with 50 or more employees), on a sustained basis for at least six months.

- Incentives for Employers:

- For an additional employee with an EPF base wage up to ₹10,000: Employer receives up to ₹1,000 proportionately.

- For an additional employee with an EPF base wage between ₹10,000 and ₹20,000: Employer receives ₹2,000.

- For an additional employee with an EPF base wage over ₹20,000 but under ₹1 lakh: Employer receives ₹3,000.

- Duration of Benefits: Applicable to jobs created between 1 August 2025 and 31 July 2027. For the manufacturing sector, incentives are extended to the 3rd and 4th years as well.

- Scale of Incentives: An employer in the non-manufacturing sector hiring 100 additional employees could receive up to ₹72 lakh over two years, while a manufacturing sector employer could get ₹1.44 crore over four years.

- Origin: The scheme was originally mentioned in the FY25 budget as one of five schemes to facilitate employment, skilling, and other opportunities.

Need Behind this Scheme:

- Youth Unemployment and Informal Hiring: The scheme “tackles two of the biggest challenges in India’s labour market—youth unemployment and informal hiring”.

- Formalization: It “encourages youth to look at formal wage-led jobs instead of part-time, gig or other informal means of livelihood”. Formalization provides dignity, security, and social security benefits to workers.

- Boost Consumption: The scheme, combined with “reduced interest rates and income tax reduction at entry level,” aims to provide youth with “a lot more disposable income for consumption”.

- High Regulatory Costs for Businesses: The scheme indirectly addresses “regulatory costs which often disincentivize businesses from hiring more”.

Current Gap in Skills (Industry Requirements vs. Workforce Availability):

- The article highlights a critical concern from an HR consultant: an annual salary of ₹1 lakh (about ₹8,000 per month) “often doesn’t meet the minimum wage bracket and the candidate has to be extremely unskilled”.

- This implies a discrepancy where industries seek skilled labour, but the scheme’s incentives might disproportionately target very unskilled workers, raising questions about whether companies would “invest in them to see a return on their investment”. This points to a significant skill gap.

Parallels to PLI Scheme and Positive Changes:

- Production-Linked Incentive (PLI) Scheme: This scheme, successful in boosting manufacturing output and exports in several sectors, offers incentives based on incremental sales from products manufactured in India. It focuses on output and investment.

- ELI Scheme Parallels: The ELI scheme draws parallels by offering direct financial incentives, similar to PLI, but linked specifically to employment generation and formalization.

- Positive Changes:

- Formalization Push: Like PLI incentivizing manufacturing, ELI directly incentivizes formal employment, potentially shifting a large segment of the workforce from informal to formal sectors.

- Increased Employer Participation: By providing financial benefits, the scheme encourages employers to expand their workforce, especially first-time employees.

- Boost to Manufacturing: The extended incentives for the manufacturing sector (3rd and 4th years) will help “boosting manufacturing”.

- Symbiotic Link with SDG 8: The scheme has the potential to “generate positive spillovers” and, if “governed constructively,” will “augment productive employment opportunities.” This fosters India’s progress towards Sustainable Development Goal (SDG) 8 (Decent Work and Economic Growth), creating a “symbiotic link between decent work and economic growth”.

Analysis of the Article: Decoding the ELI Scheme’s Impact and Challenges

The ELI scheme is a well-intentioned policy aiming to formalize India’s vast workforce and boost employment, but its success will depend on navigating challenges related to skill gaps and broader economic demand.

1. Incentivizing Formalization and Consumption:

- The scheme’s core strength lies in its direct financial incentive to employers for bringing first-time employees into the formal EPFO net.

- By targeting lower income brackets and coinciding with “reduced interest rates and income tax reduction at entry level,” the scheme aims to simultaneously increase disposable income, thereby boosting consumption in the economy.

2. Industry’s Welcome and Broader Alignment:

- The industry has “welcomed the ELI scheme”.

- Anish Shah, former president of FICCI, praised it as “smart, inclusive policymaking” that aligns with industry aspirations for “dignity, security, and formalization”.

- The scheme’s focus on India’s “biggest asset—labour” is a recognition of the demographic dividend.

3. Key Challenges and Criticisms:

- Skill Mismatch and Investment Returns: A significant concern raised by an HR consultant is the target salary bracket (up to ₹1 lakh annually or ~₹8,000/month), which often implies “extremely unskilled” labour. In a job market where skilled labour is in demand, companies might be hesitant to hire very unskilled talent and then invest in their training, questioning the “return on their investment”. This highlights a potential mismatch between the scheme’s incentives and industry’s demand for productive, skilled labour.

- Derived Demand for Labour: A fundamental economic principle highlighted is that “demand for labour is derived demand, it comes from the rest of the economy”. This implies that while incentives can encourage hiring, sustained job growth ultimately depends on the robust performance of the broader economy. If the economy doesn’t perform well, the scheme’s impact might be limited.

- Addressing Regulatory Costs: The article notes that while the scheme aims to reduce the burden of adding employees to the roster, there’s a need to also “cut regulatory costs so businesses can thrive on their own”. This indicates that broader business environment reforms are still needed.

4. Potential for Positive Spillovers and Long-Term Impact:

- Despite the immediate concerns, the scheme has the “potential to generate positive spillovers”.

- If “governed constructively,” it can “augment productive employment opportunities” and contribute to Sustainable Development Goal (SDG) 8 (Decent Work and Economic Growth). This implies that continuous monitoring, evaluation, and potential adjustments to the scheme will be crucial for its long-term success and to ensure it genuinely leads to productive employment.

In conclusion, the ELI scheme is a strategic, incentive-based approach to address India’s critical challenges of youth unemployment and informalization. While it has garnered industry support and offers significant financial benefits, its ultimate success will hinge on its ability to effectively bridge the skill gap, integrate with broader economic growth drivers, and potentially be complemented by further regulatory easing to foster a more robust and self-sustaining job market.

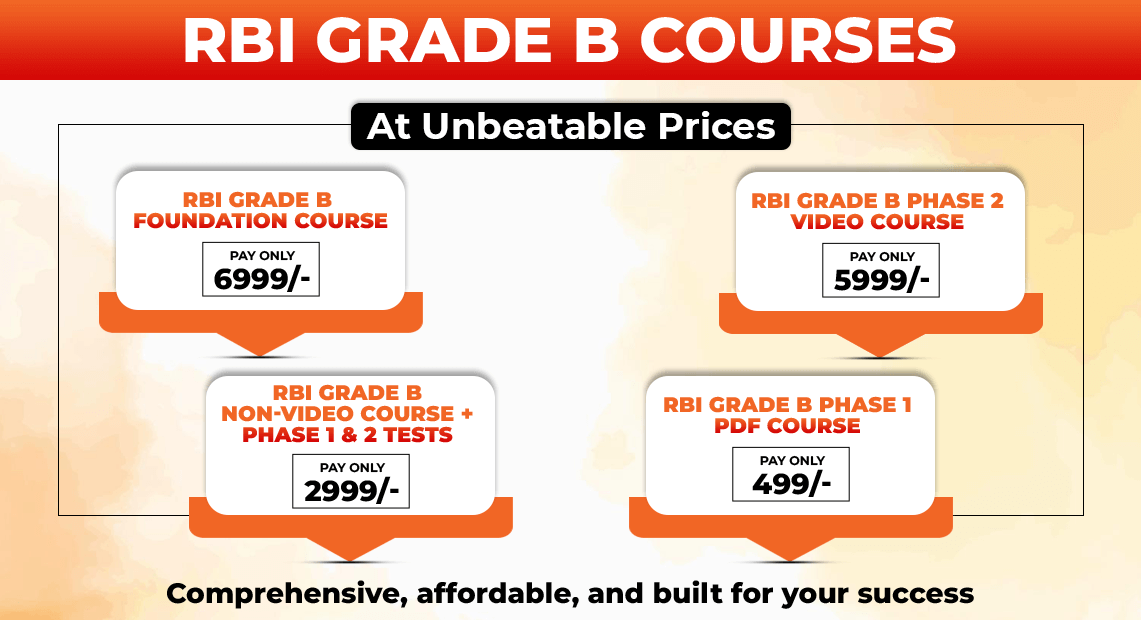

Ready to start your RBI Grade B journey? Start preparing with the courses below!

Financial Conditions Index (FCI)

Context: A financial conditions index (FCI), as proposed by a paper in RBI’s monthly bulletin for June, could aid monetary policy. But such a tool can only be an input for human judgement—and correlation must never be confused with causation.

Source: Mint

The Reserve Bank of India’s (RBI) latest Financial Stability Report presents an optimistic outlook on India’s financial system, noting eased financial conditions. However, assessing these conditions is inherently complex, given the multitude of influencing factors. To provide a clearer, high-frequency gauge of market dynamics, the RBI’s monthly bulletin for June has proposed the development of a Financial Conditions Index (FCI). This composite indicator aims to aggregate signals from various financial market segments, potentially offering valuable insights for policymakers and market participants.

Meaning and Aspects of Financial Condition:

Financial condition refers to the overall state of the financial system and markets in an economy. It reflects how easily and affordably economic agents (households, businesses, and governments) can obtain funding, manage their finances, and engage in financial transactions.

- Aspects of Financial Condition: Financial condition is a complex outcome influenced by a mix of factors, typically encompassing:

- Monetary Policy Stance: How accommodative or tight the central bank’s policy is.

- Interest Rates: Levels of short-term and long-term interest rates.

- Credit Availability: Ease of obtaining loans from banks and other financial institutions.

- Asset Prices: Valuations in equity, bond, and real estate markets.

- Exchange Rates: The value of the domestic currency relative to foreign currencies.

- Market Volatility: The degree of fluctuations in financial markets.

- Risk Appetite: Investor willingness to take on risk.

- Credit Spreads: The difference in yields between risky and risk-free assets.

- Objectives of a Financial Conditions Index (FCI): The proposed FCI by RBI aims to:

- Construct a “composite indicator that tracks overall conditions in financial markets at a high frequency”.

- Provide a “high-frequency gauge of how tight or easy financial market conditions are, relative to their historical average since 2012”.

- Offer “valuable insights into the broader financial environment” to potentially aid policymakers, analysts, and market participants in decision-making.

- Examples of such indices being used: Many central banks and financial institutions globally construct FCIs, though their methodologies and components vary:

- US: The Chicago Fed National Financial Conditions Index (NFCI) is a widely cited example, published weekly. The Kansas City Fed’s Financial Stress Index (KCFSI) is another.

- Eurozone: The European Central Bank (ECB) monitors various financial conditions indicators.

- UK: The Bank of England (BoE) also tracks financial conditions to inform its monetary policy.

- Canada: The Bank of Canada uses a Financial Conditions Index. These indices typically aggregate data from money markets, bond markets, equity markets, and foreign exchange markets to provide a single measure of financial tightness or ease.

Analysis of the Article: Decoding the Proposed Financial Conditions Index (FCI)

The article delves into the rationale, components, and potential caveats of the RBI’s proposed FCI, positioning it as a useful tool for policymakers.

1. The Need for an FCI:

- Difficulty in Assessment: “Financial conditions are notoriously hard to assess” because they are the “outcome of a complex mix of factors”.

- Bearing on Financial Stability: Despite the difficulty, financial conditions have an “enormous bearing on the overall health of the system and hence on financial stability”. This underscores the importance of a comprehensive tracking tool.

2. Proposed Components and Rationale:

- The proposed index would use 20 financial market indicators representing five segments.

- Money Market: Considered the “fulcrum of monetary policy operations”. Most central banks implement monetary policy via the overnight money market. The deviation of the weighted average call rate (RBI’s operating target) from the RBI’s repo rate is taken as an indicator of market tightness/ease.

- Government Securities (G-Secs) Market: (Rationale well argued, but details not specified in the content) This market reflects government borrowing costs and risk-free rates, influencing other market segments.

- Corporate Bonds Market: (Rationale well argued, but details not specified in the content) Reflects corporate borrowing costs and credit risk perceptions.

- Foreign Exchange Market: (Rationale well argued, but details not specified in the content) Reflects currency strength, capital flows, and external competitiveness.

- Equity Market: (Rationale well argued, but details not specified in the content) Reflects investor sentiment, corporate profitability expectations, and overall economic health. The article suggests that a “broader index like the 50-share Nifty instead of the 30-share Sensex” might better represent the equity market, but these details can be fine-tuned.

3. Surprising Omission of Growth Rate:

- A “somewhat surprising omission” from the FCI indicators is the economy’s growth rate.

- Rationale for Inclusion: The article argues that while good financial conditions favor faster economic expansion as an outcome, all five broad market indicators are also a function of the underlying state of the economy. Therefore, “GDP growth is a valid input for such an index”.

4. Crucial Caveats Before Policy Relevance:

- Tool, Not a Replacement for Judgment: Even the best tool “is just a tool. It can supplement but never supplant human judgement and discretion”. This echoes former RBI governor Y.V. Reddy’s famous saying, “Monetary policy is an art, not a science”.

- Past as a Guide, Not a Predictor: “The past can only be a guide; it cannot foretell the future.”

- Correlation vs. Causation: Crucially, “correlation is not causation.” Two variables can move together without one causing the other. This distinction is vital to avoid misinterpreting index movements for policy decisions.

5. Potential Role in RBI Policy:

- As long as the two caveats (tool vs. judgment, correlation vs. causation) are met, FCI readings “could conceivably come to play a role in the formulation of RBI policy”.

- Test runs could provide valuable insights for policymakers.

In conclusion, the RBI’s proposal for a Financial Conditions Index is a significant step towards a more data-driven and real-time assessment of India’s financial markets. While the index promises to aggregate complex market signals into a high-frequency gauge, its effective utilization in policymaking will require a nuanced understanding of its limitations, ensuring it remains a supplementary tool to human judgment and is not confused with causal relationships.

Research, Development and Innovation (RDI) Scheme

Context: The scheme is aimed at fostering local innovation and reducing reliance on foreign patents. It targets diverse industries, including green energy and AI, to strengthen India’s tech infrastructure..

Source: Mint

India has launched the ambitious Research Development and Innovation (RDI) Scheme, with a substantial outlay of $12 billion (₹1 trillion), to bolster research, development, and innovation in its critical technology and electronics sectors. This move addresses a long-standing industry demand to shift India’s role from merely assembling electronic devices to designing and owning foundational, patented technologies. The scheme aims to reduce India’s vulnerability to geopolitical pressures and cyber threats by fostering indigenous technological capabilities.

Importance of Research and Development (R&D) in the Economy:

Research and Development (R&D) encompasses creative work undertaken on a systematic basis to increase the stock of knowledge, including knowledge of humanity, culture, and society, and the use of this stock of knowledge to devise new applications. It is a critical driver of economic progress.

- Innovation and Competitiveness: R&D is the engine of innovation, leading to new products, services, and processes. This enhances a country’s global competitiveness, allowing its industries to offer unique value propositions and maintain an edge in the international market. The article highlights that India currently builds applications but mostly on “foundational, patented technologies developed by companies in the US, China, Japan, Korea and the European Union,” meaning “the fundamental innovation layer in most technologies is not owned by India today”.

- Productivity Growth: Investment in R&D improves labour productivity by developing more efficient methods of production and enhancing the quality of goods and services.

- Economic Growth: R&D fuels long-term economic growth by creating new industries, expanding existing ones, and generating high-value jobs.

- National Security and Strategic Autonomy: Owning foundational technologies is crucial for national security and strategic autonomy. The article explicitly states that not owning “fundamental design patent of critical technologies such as communications network infrastructure leaves India vulnerable to cyber warfare and other such concerns”. It cites the Maharashtra power grid cyber-attack in 2020 as a major example of this vulnerability.

- Job Creation: R&D generates demand for highly skilled labour, fostering a knowledge-based economy.

- Addressing Societal Challenges: R&D can lead to solutions for pressing societal issues such as climate change, healthcare, and food security.

Multiplier Effect due to Investments in RDI

Investments in Research, Development, and Innovation (RDI) typically generate a significant multiplier effect on the economy.

- Beyond Direct Impact: The initial investment in R&D not only creates jobs and output directly within research institutions and technology firms but also has ripple effects across various sectors.

- Spillover Benefits: New technologies developed through R&D can improve efficiency and create new products in other industries, leading to increased productivity and economic growth across the board. For example, a breakthrough in materials science could benefit manufacturing, aerospace, and energy sectors simultaneously.

- Increased Competitiveness: The overall enhancement of technological capabilities makes the entire economy more competitive, attracting further investment and stimulating exports.

- Higher Skilled Workforce: As R&D expands, it creates demand for a highly skilled workforce, leading to investments in education and training, which further boosts human capital and future productivity.

India’s Expenditure on R&D to GDP Ratio vs. Other Countries

India’s expenditure on R&D as a percentage of its GDP has historically been low compared to major technologically advanced nations.

India: The article states that the “median level of R&D investment in the private sector is about 0.6%”. Even India’s largest technology firm, Tata Consultancy Services, invests only 1.1% of its yearly revenue in R&D. Overall public and private R&D expenditure combined is usually around 0.7% of GDP.

Other Countries:

- Google (company-specific): Invests “almost 15% of its quarterly revenue in R&D“.

- China and Japan (private companies): Private companies in these countries invest “up to 5% of their revenue in R&D“.

- Global Benchmarks (general knowledge):

- USA: Typically around 3.0-3.5% of GDP.

- Germany: Around 3.0-3.2% of GDP.

- Japan: Around 3.2-3.5% of GDP.

- Israel: A global leader, often spending over 5% of its GDP on R&D. This stark contrast highlights the significant gap India needs to bridge to foster foundational innovation.

Analysis of the Article: Decoding the RDI Scheme’s Impact

The RDI Scheme is a landmark initiative designed to address India’s long-standing deficit in foundational R&D, particularly in critical technology sectors, with a clear focus on achieving strategic autonomy.

1. The RDI Scheme: Purpose and Funding Mechanism:

- Purpose: To “support research, development and innovation (RDI) in India’s technology and electronics sectors”. This comes after “decades of industry demands seeking promotion of designing electronics in India—and not just assembling consumer devices”.

- Outlay: A net outlay of $12 billion (₹1 trillion) spread over multiple years.

- Implementing Body: The scheme will operate under the Anusandhan National Research Foundation (ANRF), with the Department of Science and Technology (DST) serving as the nodal department.

- Two-tiered Funding Mechanism:

- First Level: A Special Purpose Fund (SPF) established within the ANRF will act as the custodian of funds.

- Second Level: Funds from the SPF will be allocated to a variety of 2nd level fund managers, primarily in the form of long-term concessional loans (low or nil interest rates).

- Equity Financing: Equity financing may also be done, “especially in case of startups”. Contribution to Deep-Tech Fund of Funds (FoF) or any other RDI-focused FoF may also be considered.

- Oversight: A group of secretaries under the Cabinet Secretary will oversee fund allocation and appoint fund managers.

2. Eligible Companies and Strategic Sectors:

- Companies working on green energy solutions, biotechnology device manufacturers, pharmaceuticals and medical devices, artificial intelligence solutions for agriculture, health and education, digital economy stakeholders (e.g., financial services), deep-tech applications (e.g., quantum computing, robotics, space), and “strategic” technologies serving national security and public utilities are eligible for funds.

3. Why the Scheme is Necessary (“Why”):

- Lack of Foundational Innovation: India’s technology ecosystem relies heavily on “secondary layers of applications and innovations,” built on foundational, patented technologies owned by companies in the US, China, Japan, Korea, and the EU.

- Geopolitical Vulnerability: This reliance creates a risk of “economic sanctions in case of a conflict” and leaves India “vulnerable to cyber warfare and other such concerns” due to not owning fundamental design patents of critical technologies like communications network infrastructure.

- Low Private Sector R&D Investment: The median R&D investment in India’s private sector is about 0.6%, significantly lower than 5% in China and Japan, or Google’s 15% of quarterly revenue.

4. Potential Impact and Challenges (“How”):

- Shift from Assembly to Design: The scheme aims to help India move beyond large-scale assembly of electronic devices (e.g., Dixon Technologies, Bhagwati Products, Kaynes Technology, Amber, Bharat Foxconn) to “build such patents and help India develop its own critical technology infrastructure”.

- Semiconductor Industry: While India has almost one-fifth of the world’s chip design engineers, it “does not own any semiconductor intellectual property (IP)” and relies on US firms (AMD, Intel, Nvidia, Qualcomm) for chip reference designs. These core designs power critical infrastructure (networking hardware, financial services, power grids). The RDI scheme aims to address this.

- Long-Term Goal of Indigenization and Scale: Building patents “requires years of investing”. Achieving scale, as seen in the US and China (which sell at significantly low costs), “will take time” for India. The long-term goal is to “replace tech infrastructure sourced from other countries with an indigenous stack,” leading to indigenization.

- Interoperability: This indigenization “does not mean that all tech in India will be indigenous… in silos.” Instead, Indian technologies will “look to comply with global tech infrastructure and be interoperable with what the US and China build”. This implies a strategy of strategic self-reliance with global integration.

- Execution is Key: The success of the RDI scheme will “much depend on execution”.

In conclusion, the RDI Scheme is a transformative initiative by the Indian government to propel India from a technology assembler to a global innovator. By offering significant financial support and targeting critical sectors, it aims to foster indigenous R&D, enhance strategic autonomy, and reduce vulnerability to geopolitical risks. While the path to building foundational patents and achieving scale will be long and challenging, the scheme represents a crucial commitment to India’s technological future, emphasizing both self-reliance and global interoperability.

- Sign Up on Practicemock for Updated Current Affairs, Topic Tests and Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Stenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test