In the banking sector, understanding Know Your Customer (KYC) and Anti-Money Laundering (AML) is essential for maintaining financial integrity. KYC involves verifying customer identities to assess risk and prevent fraud, while AML focuses on detecting and reporting suspicious activities that may indicate money laundering. For banking students, mastering these concepts is crucial for building a career in compliance, risk management, or financial operations. As global regulations tighten and financial crimes grow more complex, banks must stay vigilant. This blog introduces the fundamentals of KYC and AML, their real-world applications, and why they are vital to a secure banking environment.

What Is KYC?

KYC stands for Know Your Customer. It’s a process used by banks and financial institutions to confirm the identity of their customers. The main aim is to stop illegal activities like fraud, corruption, and money laundering. By knowing who their customers really are, banks can keep the financial system safe and trustworthy.

Why Is KYC Important?

KYC is more than just paperwork; it’s a protective shield for the banking world. Here’s why it matters:

- Protects against criminals: Stops people from using fake identities to commit crimes.

- Confirms real identity: Ensures that the person opening an account is genuine.

- Follows the law: Helps banks follow government rules and regulations.

- Builds trust: Customers feel safer knowing their bank is secure and responsible.

What Does KYC Involve?

When you open a bank account or do financial transactions, the bank will ask for certain documents to verify your identity. These usually include:

- Proof of identity: Passport, Aadhaar card, voter ID, or driving license.

- Proof of address: Utility bill, rental agreement, or bank statement.

- Photograph: A recent passport-size photo.

- PAN card: Required in India for financial transactions and tax purposes.

These documents help banks know who you are and where you live.

What Is Money Laundering?

Money laundering is when criminals try to make illegal money look legal. They use banks, businesses, and fake companies to hide where the money came from. This is a serious crime because it allows people to use dirty money without getting caught.

How Does Money Laundering Work?

There are three main stages of money laundering:

- Placement: The criminal puts illegal money into the financial system. For example, depositing large amounts of cash into a bank account.

- Layering: The money is moved around to confuse its origin. This could involve wire transfers, offshore accounts, or fake companies.

- Integration: The money is now mixed with legal funds and used to buy things like property, cars, or luxury items, making it look clean.

How KYC Helps Prevent Money Laundering

KYC acts like a security filter. It helps banks and financial institutions:

- Spot suspicious transactions: Unusual deposits or transfers can raise red flags.

- Monitor customer behaviour: If someone suddenly starts moving large amounts of money, the bank can investigate.

- Report to authorities: If something seems wrong, banks report it to agencies like the Financial Intelligence Unit (FIU) in India.

By doing this, KYC helps stop criminals from using banks to clean their dirty money.

Why Banking Students Should Care

If you’re studying banking or planning to work in finance, understanding KYC and money laundering is very important. You’ll be responsible for:

- Checking customer documents: Making sure they are real and complete.

- Spotting red flags: Noticing unusual activity or fake information.

- Following AML laws: AML stands for Anti-Money Laundering, and you’ll need to make sure your bank follows these rules.

Final Thoughts

KYC is not just a routine step; it’s a powerful tool that protects the financial system. It keeps banks safe, helps fight crime, and builds trust between customers and institutions. For banking students, learning about KYC and money laundering is a key part of becoming a responsible professional. By understanding these concepts, you’ll be ready to play your part in keeping the financial world clean and secure.

Join our exclusive Telegram group where our experts are ready to answer all your queries, guide you in banking exam preparation, and give personalised tips to boost your success. Get access to real-time solutions, expert advice, and valuable resources to improve your study journey.

Other Related Blogs

FAQs

KYC stands for Know Your Customer. It refers to the process banks use to verify the identity of their clients before opening accounts or conducting financial transactions. KYC is crucial because it prevents identity theft and financial fraud and helps detect and prevent money laundering and terrorist financing, and ensures compliance with regulatory requirements

Money laundering is the illegal process of making large amounts of money generated by criminal activity appear to be earned legitimately. It affects the financial system by undermining the integrity of financial institutions. Facilitating corruption and organised crime. Distorting economic data and investment flows.

Banks use a combination of tools and procedures, including Customer due diligence (CDD) and enhanced due diligence (EDD), Transaction monitoring systems to flag suspicious activity, reporting suspicious transactions to Financial Intelligence Units (FIUs), and Regular staff training on anti-money laundering (AML) compliance.

The Prevention of Money Laundering Act (PMLA), 2002, is India’s key law to combat money laundering. It criminalises the process of concealing illicit funds and empowers authorities to seize assets linked to crime. The Enforcement Directorate investigates cases, while financial institutions must report suspicious transactions. Offenders face 3–7 years of imprisonment, extendable to 10 years for drug-related crimes. The Act aligns India with global anti-money laundering standards and places the burden of proof on the accused.

The Reserve Bank of India updated its KYC Master Directions in 2023 to enhance anti-money laundering compliance. Key changes include lowering the threshold for identifying beneficial owners in partnership firms from 15% to 10%, expanding the definition of “control,” mandating appointment of a Principal Officer for KYC oversight, and including Asset Reconstruction Companies under the KYC framework. These updates align with amendments to the Prevention of Money Laundering Rules and global FATF standards. Regulated entities must ensure stricter customer due diligence, especially for digital transactions, and maintain robust internal controls for risk management.

The Financial Action Task Force (FATF) is an intergovernmental body established in 1989 to combat money laundering, terrorist financing, and other threats to the global financial system. It sets international standards through 40 Recommendations that member countries implement via laws and regulations. FATF conducts peer reviews (mutual evaluations) to assess compliance and maintains “grey” and “black” lists of jurisdictions with strategic deficiencies. India is a member of FATF and aligns its policies, including RBI’s KYC norms, with FATF guidelines to strengthen financial integrity and transparency.

Counter-Terrorist Financing (CFT) refers to measures aimed at preventing the flow of funds to terrorist organisations or activities. It involves identifying, tracking, and blocking financial transactions linked to terrorism. Governments and financial institutions implement CFT through laws, customer due diligence, suspicious transaction reporting, and international cooperation. CFT is closely tied to anti-money laundering (AML) frameworks and guided by global standards set by the Financial Action Task Force (FATF). In India, agencies like the RBI and FIU-IND enforce CFT norms to safeguard national security and financial integrity. Effective CFT disrupts terrorist networks by cutting off their financial lifelines.

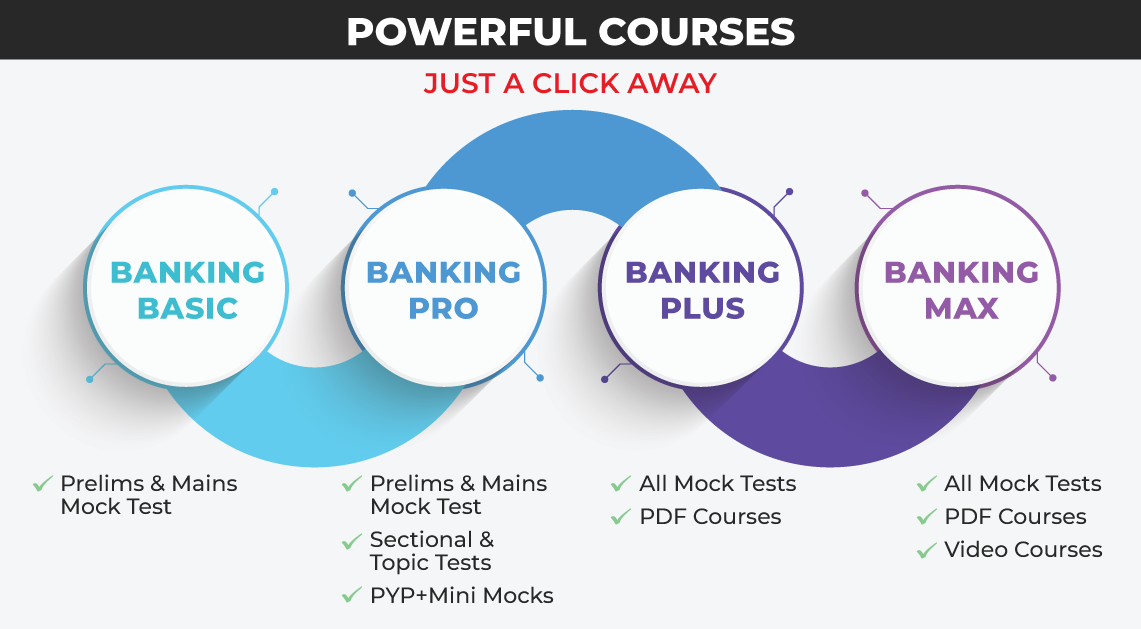

- Sign Up on Practicemock for Updated Current Affairs, Topic Tests and Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Stenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test