One of the most important topics in the Quantitative Aptitude section of the SBI PO Prelims and Mains is Simple Interest (SI) and Compound Interest (CI). Every year, multiple questions are asked on this topic, testing a candidate’s understanding of interest calculations, concept clarity, and speed of solving. In this article, we are providing an in-depth exploration of Simple and Compound Interest, tailored specifically for SBI PO aspirants, including the most asked questions along with the key concepts, formulas, shortcuts, and a compilation. Candidates can download the SI and CI questions PDF in the article below.

What is Simple and Compound Interest

Simple Interest

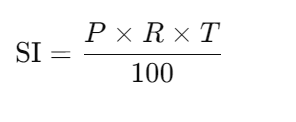

Simple Interest is calculated on the original principal amount for the entire duration of the loan or investment. The formula for calculating Simple Interest is:

Where:

- P = Principal (initial amount of money)

- R = Rate of interest per annum

- T = Time period (in years)

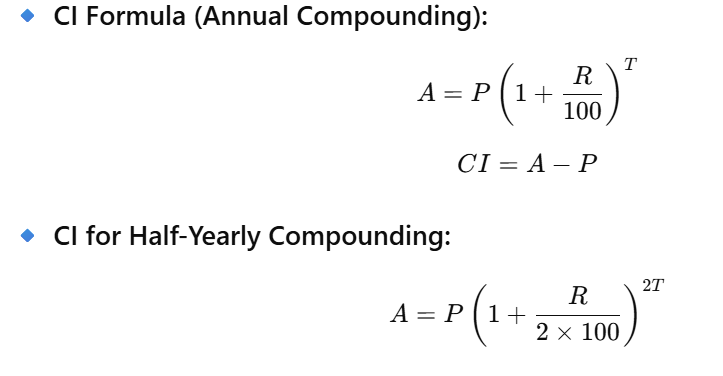

Compound Interest

Compound interest is calculated on the principal amount and the interest that accumulates over time. This means that the interest earned each period is added to the principal amount, and interest is calculated on this new amount.

Most Asked Questions for SBI PO PDF Link

Below is a sample of the most frequently asked SI and CI questions in PDF format with a detailed solution. Candidates can click the PDF link to boost their score in the quant section.

Question 1: Kausalya divided Rs. 8800 among his four sons Ram, Lakshman, Bharat, and Shatrughan such that simple interest obtained on investing the amount received by them at the rate of 8% per annum for 1 year, 2 years, 3 years, and 4 years, respectively is the same. What is the difference between the amount received by Ram and Bharat?

A) Rs. 8808

B) Rs. 1712

C) Rs. 2816

D) Rs. 2520

E) Rs. 2750

Question 2: Amit invested equal amounts in two different schemes A and B. Scheme A is offering simple interest at the rate of 20% per annum and scheme B is offering interest at the rate of 20% compounded annually. If the difference between the interest obtained from two schemes after 2 years is Rs. 420, then find the amount invested by Amit.

A) Rs. 7500

B) Rs. 10500

C) Rs. 12500

D) Rs. 15500

E) None of these

Question 3: Bharat lent some amount at 20% per annum compound interest while Mohan lent some amount at 16% per annum simple interest. If the ratio of the amount lent by Bharat and Mohan was 10:11, respectively, then find the ratio of interest earned by Mohan and Bharat in 2 years.

A) 6:7

B) 2:3

C) 4:3

D) 4:5

E) None of these

Question 4: Mrs. Singh invested Rs. 35,000 in scheme A offering 10% compound interest for three years compounded annually. She then invested the total amount she received from scheme A in another scheme offering 8% simple interest for five years. Find the total interest earned by her after eight years.

A) Rs. 30,219

B) Rs. 28,108

C) Rs. 35,585

D) Rs. 24,634

E) None of these

Question 5: Dinesh invested Rs. ‘x’ in scheme offering 12% simple interest for three years. Rohit invested Rs. ‘x + 3000’ in a scheme offering 10% compound interest for three years. Find the value of ‘x’ if the interest earned by Rohit is Rs. 761 more than the interest earned by Dinesh.

A) Rs. 9,000

B) Rs. 6,000

C) Rs. 12,000

D) Rs. 8,000

E) None of these

Simple & Compound Interest Important Questions PDF Link

Shortcuts and Tips to solve Simple & Compound Interest Questions

- Memorise Key Formulas: Ensure you know the SI and CI formulas, including variations for different compounding frequencies.

- Use Difference Shortcut: For 2-year SI vs. CI questions, the difference formula (P × (R/100)^2) saves time.

- Approximation for CI: For small rates, CI ≈ SI + (P × (R/100)^2 × T/2). This is useful for quick estimates.

- Practice Percentage Squares: Memorise squares of common percentages (e.g., (10/100)^2 = 0.01) for faster calculations.

- Time Management: In Prelims, aim to solve SI/CI questions in 1–2 minutes. In Mains, allocate 2–3 minutes for complex DI-based questions.

- Mock Tests: Regularly practice with mock tests from platforms like PracticeMock or Oliveboard to simulate exam conditions.

How to Master SI & CI for SBI PO 2025?

Step-by-Step Strategy:

- Concept Clarity First:

Start with understanding basic definitions and formulas. - Practice Formula-Based Questions:

Begin with direct formula applications to gain speed. - Solve SBI PO Previous Year Questions:

Analyse the pattern and difficulty level. - Revise Short Tricks & Tables:

Keep a chart of percentage to fraction conversions. - Time-Bound Practice:

Set a timer for 20–25 minutes and solve 10 questions. - Mock Tests & Sectional Tests: Take mock tests and focus on improving accuracy and timing in arithmetic.

Disclaimer: The simple and compound interest questions, solutions, and tips provided are for practice and guidance only. They are illustrative, not official SBI PO exam content. Actual exam questions may differ in wording, format, or difficulty. Candidates should always consult official SBI notices for authentic and updated information.

Join our exclusive Telegram group where our experts are ready to answer all your queries, guide you in banking exam preparation, and give personalized tips to boost your success. Get access to real-time solutions, expert advice, and valuable resources to improve your study journey. [Click here to join now!]

Other Related Blogs on SBI PO 2025

| SBI PO Syllabus 2025 | SBI PO Previous Year Question Paper |

| SBI PO Salary 2025 | SBI PO Cut Off |

| SBI PO Study Plan 2025 | SBI PO Preparation Strategy |

| SBI PO Exam Pattern 2025 |

- Sign Up on Practicemock for Updated Current Affairs, Topic Tests and Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Stenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test