To get ready for the UPSC, RBI, SEBI, or NABARD exam, you have to stay updated about key economic and regulatory updates. In today’s edition of Vishleshan, we discuss India’s rising FDI outflows, which are a cause of concern. These issues are highly relevant for competitive exams and offer valuable insights into India’s evolving economic scenario. Keep reading to stay ahead with a clear understanding of these current updates.

Also, know why RBI Grade B Phase 1 Exam: The Silent Eliminator of 99% Aspirants & What is the Finance and Management Syllabus for RBI Grade B Exam?

India’s Rising FDI Outflows: A Cause of Concern

Context: Foreign direct investment (FDI) has been weakening globally for more than a decade, but India has lately been seeing large outflows. Since a chunk of it reflects Indian businesses investing abroad, we need to study why they’d rather not invest at home.

Link to the Article: Mint

A palpable sense of despair permeates the global landscape of Foreign Direct Investment (FDI), with flows from one country to another markedly ebbing in 2024. Three independent reports unanimously lament this decline, concluding that it spells trouble, particularly for developing countries that rely heavily on foreign investment for enhancing industrial capacity, upgrading infrastructure, modernizing technology, and expanding their renewable energy assets. For India, this global waning of FDI is further complicated by a rising tide of outward investments by Indian industry, shrinking the nation’s net FDI to a mere fraction of previous levels.

Foreign Direct Investment (FDI):

Understanding the various forms of foreign investment is crucial for comprehending their economic implications.

- What: An investment made by a firm or individual in one country into business interests located in another country, implying a lasting interest and a degree of control or influence by the investor over the foreign entity. This usually involves equity ownership of 10% or more.

- Various Forms of FDI:

- Greenfield Investment: Establishing entirely new facilities (factories, offices) in a foreign country. The article specifically mentions “greenfield FDI to emerging and developing economies… declined 25% during 2024“.

- Mergers and Acquisitions (M&A): Acquiring an existing foreign company or merging with one. The article implicitly refers to this when discussing “existing FDI investors cashing out and taking funds back home,” citing examples like Walt Disney selling Star India to Jio and Advent International selling Bharat Serum to Mankind Pharma.

- Expansion of Existing Facilities: Re-investing profits or fresh capital into expanding an already existing foreign subsidiary.

- Joint Ventures: Forming a partnership with a local company.

- Impact of Rising FDI into an Economy:

- Capital Inflow: Provides crucial capital for economic growth, infrastructure development, and industrial expansion, especially vital for developing countries.

- Technology Transfer: Brings new technologies, management techniques, and business practices.

- Job Creation: Leads to direct and indirect employment opportunities.

- Increased Exports: Boosts export capabilities, integrating the economy into global value chains.

- Enhanced Competition: Fosters competition, leading to greater efficiency and innovation in domestic industries.

- Sustainable Development: Can contribute to expanding the stock of renewable energy assets, reducing dependence on fossil fuels.

Foreign Portfolio Investment (FPI):

- What: Involves investing in financial assets like stocks, bonds, mutual funds, or other securities of a foreign country, but without gaining control or significant influence over the company or its operations. FPI is generally short-term and more liquid than FDI.

- Various Forms of FPI:

- Equity FPI: Investing in shares of foreign companies listed on stock exchanges.

- Debt FPI: Investing in government bonds, corporate bonds, or other debt instruments of a foreign country.

- Mutual Funds/ETFs: Investing through funds that hold a portfolio of foreign securities.

- Impact of Rising FPI into an Economy:

- Capital Inflow: Provides readily available capital for financial markets, boosting liquidity.

- Currency Appreciation: Can lead to an appreciation of the domestic currency due to increased demand for it.

- Market Volatility: FPI is highly sensitive to market sentiment and interest rate differentials. Large inflows or sudden outflows can lead to significant market volatility and currency fluctuations.

- No Direct Productive Capacity: Unlike FDI, FPI does not directly create industrial capacity or long-term jobs.

Difference between FDI and FPI:

- Control/Influence: FDI implies control/influence; FPI does not.

- Nature of Investment: FDI is typically long-term and strategic; FPI is short-term and speculative.

- Liquidity: FPI is highly liquid (easy to buy/sell shares); FDI is illiquid (difficult to immediately liquidate physical assets).

- Risk: FDI is generally considered less volatile (though exposed to country risk); FPI is more volatile and susceptible to sudden reversals.

- Economic Impact: FDI has a direct impact on productive capacity, technology transfer, and job creation; FPI primarily impacts financial markets and currency.

Analysis of the Article: Decoding the Global and Indian FDI Trends

The article, drawing from three key reports, paints a concerning picture of declining global FDI flows and highlights India’s unique challenge of rising outward investments.

1. Global Decline in FDI Flows:

- Marked Ebbing: FDI flows from one country to another have “ebbing markedly in 2024”.

- Three Reports Confirm Decline:

- UNCTAD’s World Investment Report 2025: States that FDI flows fell 11% in 2024, marking a “second straight year of decline,” with a “disheartening” prognosis for 2025 due to “high investor uncertainty”.

- OECD Report: Flows to the G-20’s non-OECD economies (which includes India) declined by 30% in 2024. China “witnessed a decline for the third consecutive year”.

- World Bank’s “Foreign Direct Investment in Retreat” Report: States that greenfield FDI to emerging and developing economies “declined 25% during 2024“. This indicates a “growing distaste for setting up new manufacturing facilities in these markets”.

- 2008 GFC as Turning Point: All three reports highlight the 2008 financial crisis as a turning point for global FDI, with flows as a share of global GDP declining from 5% in 2007 to below 1% during both 2023 and 2024, reaching the “lowest since the start of this century”.

- Primary Reasons for Decline: The reports attribute the waning FDI to “heightened trade tensions, policy uncertainty and a breakdown of global value chains due to rising protectionism”. These factors have “contributed to a weakening of the global macroeconomic backdrop”.

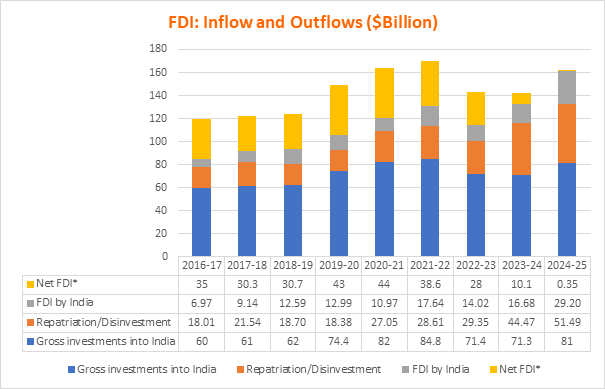

Net FDI = Gross investments into India – (Repatriation/Disinvestment + FDI by India)

2. India’s FDI Landscape: Mixed Signals and Rising Outflows:

- Overall Inflow Rank: The UNCTAD report places India at 15th rank in 2024 among FDI recipients, a marginal improvement from 16th in 2023.

- Greenfield Activity: Greenfield activity was “reportedly strong in India (led by semiconductor and metal projects)”. However, international project finance inflows contracted by 37%.

- Collapsing Net FDI: While gross investments into India have “held up” (reaching $81 billion in 2024-25), a “spike in India Inc’s foreign investments and overseas businesses cashing out of the country shrank India’s net FDI to a mere $0.35 billion last fiscal year“.

- This represents a drastic fall from $10.1 billion in 2023-24 and $35 billion in 2016-17.

- Net FDI = Gross investments into India – (Repatriation/Disinvestment + FDI by India).

3. The Rise of Outflows from India:

- Repatriation/Disinvestment: This category, where existing FDI investors cash out, has risen sharply. Repatriation/Disinvestment amounted to $51.49 billion in 2024-25, a significant increase from $18.01 billion in 2016-17. Examples include Disney selling Star India to Jio and Advent International selling Bharat Serum to Mankind Pharma.

- FDI by India (Indian Businesses Investing Overseas): This is deemed “more disconcerting”. Outflows under this category in 2024 “jumped 75% over the previous year“. Compared to 2016-17, these outflows were “more than four times larger,” reaching $29.20 billion in 2024-25 from $6.97 billion in 2016-17.

- Push Factors for Outflows (World Bank): The World Bank report identifies “push factors” encouraging FDI outflows from source countries: “weak growth prospects, macroeconomic risks, political instability, rising production costs, and deterioration of the regulatory environment”.

4. Counter-Intuitive Outflows and Policy Mismatch:

- The growing volume of outflows seems “counter-intuitive” because the Indian government has initiated policies to facilitate FDI inflows (e.g., higher FDI caps in insurance and defence, liberalized rules for construction/retail) and expedite domestic manufacturing (e.g., PLI scheme).

- India’s status as a “low-middle income economy” and the rupee’s internationalization being lower than the renminbi’s make it atypical for such large outward FDI flows.

- Imperative for Government: It has become “imperative for the Indian government to probe the reasons behind India Inc’s reluctance to invest at home, despite all the incentives, low interest rates and generous tax breaks”.

In conclusion, the global FDI landscape is facing a significant downturn, primarily driven by trade tensions, policy uncertainty, and shifts in global value chains. While India manages to maintain a decent rank in gross FDI inflows, its net FDI has plummeted due to a sharp rise in both foreign investors cashing out and, more notably, Indian companies increasingly preferring overseas investment destinations. This counter-intuitive trend, despite government incentives for domestic investment, highlights a critical issue that requires urgent investigation to understand why Indian businesses are reluctant to invest at home.

- Sign Up on Practicemock for Updated Current Affairs, Topic Tests and Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Stenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test