NIACL AO or LIC AAO: Both exams belong to the insurance world. But many are confused about which job is to be preferred over the other. It’s a reasonable doubt to have as both jobs have good pay and career growth opportunities. LIC, being a bigger brand, attracts more eyeballs and on the other NIACL AO, being a typical government job, attracts aspirants who aspire for a 9-5 job with fewer hassles.

Here are the following parameters included for the comparison

- Selection Process

- Job Profile

- Salary Structure

- Career Growth

- Posting/Transfer Policy

- Bond Signing

NIACL AO (Generalist) or LIC AAO – A basic comparison

| CATEGORY: | LIC AAO | NIACL AO |

| JOB PROFILE | Public Dealing, desk job, Customer query Settlements, assisting in designing new schemes | Client Interaction, Auditing and Analysing, and Policy Making |

| POSTING | Urban/Rural | Urban |

| PROMOTIONS | Experience-based | After 5-8 years |

| TRANSFER | After 3 years | After 3-5 years |

| EXAMINATION TYPE | Online: Prelims + Mains | Online: Prelims + Mains |

| BOND | 4 Years | 4 years |

Selection Procedure

The overall selection process is the same for both exams.

| NIACL AO | LIC AAO |

| An objective examination along with a descriptive test during mains. 3 Rounds of the selection process: Prelims, Mains, Personal Interview | An objective examination along with a descriptive test during mains. 3 Rounds of the selection process: Prelims, Mains, Personal Interview |

Eligibility Criteria for NIACL AO (Generalist)

Age Limit

As of September 01, 2025

- Min: 21 years

- Max: 30 years

Age Relaxation:

- SC/ ST: 5 years

- OBC (Non-Creamy Layer): 3 years

Educational Qualification

Graduate/postgraduate in any discipline from a recognised University or any equivalent qualification recognised as such by the Central Government, with at least 60% marks in either of the degree examinations for General candidates and at least 55% marks for SC/ST/PwBD candidates.

Eligibility Criteria for LIC AAO

- Minimum Age- 21 years

- Maximum Age- 30 years

Educational qualification is pretty much the same as NIACL AO, but different categories, such as CA, Rajbhasha, legal, etc., have different educational qualification criteria.

Salary Structure

| NIACL AO | LIC AAO |

| Candidates should know all about the NIACL AO in-hand salary. The basic pay of NIACL AO Salary 2025 Scale-I is Rs. 32,795/-. Plus, the employees get additional allowances with the pay scale of 32795-1610(14)-55335-1745(4)-62315. The total monthly NIACL AO Salary enjoyed by an AO or Administrative Officer (Generalist) is around Rs. 80,000 in Metropolitan cities and between Rs. 75,000 to 80,000 in other cities. | LIC AAOs (Generalist) start with a basic pay of ₹88,635/month, under the revised pay scale of ₹88,635–₹4,385 (14 years)–₹1,50,025–₹4,750 (4 years)–₹1,69,025. In “A-class” metro cities, including DA, HRA, CCA, and transport allowance, the gross emoluments reach around ₹1,26,000. After deductions such as income tax, GIS premium, professional tax, and GI scheme contributions, the net in-hand salary stands at approximately ₹1,07,222/month |

Job Profile Comparison

| LIC AAO | NIACL AO |

| LIC AAO is primarily an administrative job with various responsibilities like: -Interacting with clients -Managing databases underwriting -Brainstorming on new policies and schemes And more. | The role of Generalist AO is to supervise and assist on the NIACL’s risk assessments and verify risk proposals. Risk management or planning includes assessing all the potential risks that might affect the Company or the organization. |

Career Growth Comparison

| LIC AAO | NIACL AO |

| Experience-based promotions are there. 1. Administrative Officer (AO) 2. Assistant Divisional Manager (ADM) 3. Divisional Manager (DM) 4. Senior Divisional Manager (SDM) 5. Zonal Manager and so on. | Internal exams, certificate courses, seniority, etc., would strongly determine the AO’s promotion and career growth. You can expect to be upgraded as the scale II officer soon enough once you clear such an internal exam. The general period in the job for becoming a scale-II officer is three years. But otherwise, regular promotions in NIACL need at least five years of work. We can assume it has more to do with seniority. Further from here, you can expect promotions at the interval of every three years. You will have a raise in your perks and basic salary as well. Every five years, the employees of NIACL can expect a wage revision as per the guidelines. |

NIACL AO or LIC AAO – Transfer Policy

| LIC AAO | NIACL AO |

| Transfers happen every 2.5 to 3 years. Can be transferred to Rural or Urban Areas | Transfers happen every 3 to 5 years. |

NIACL AO or LIC AAO – BOND

| LIC AAO | NIACL AO |

| LIC AAO has a 4 years bond. If any employee wants to leave LIC during the bond period, then they are liable to pay ₹2,00,000. | A minimum period of four years including a probation period. |

Conclusion

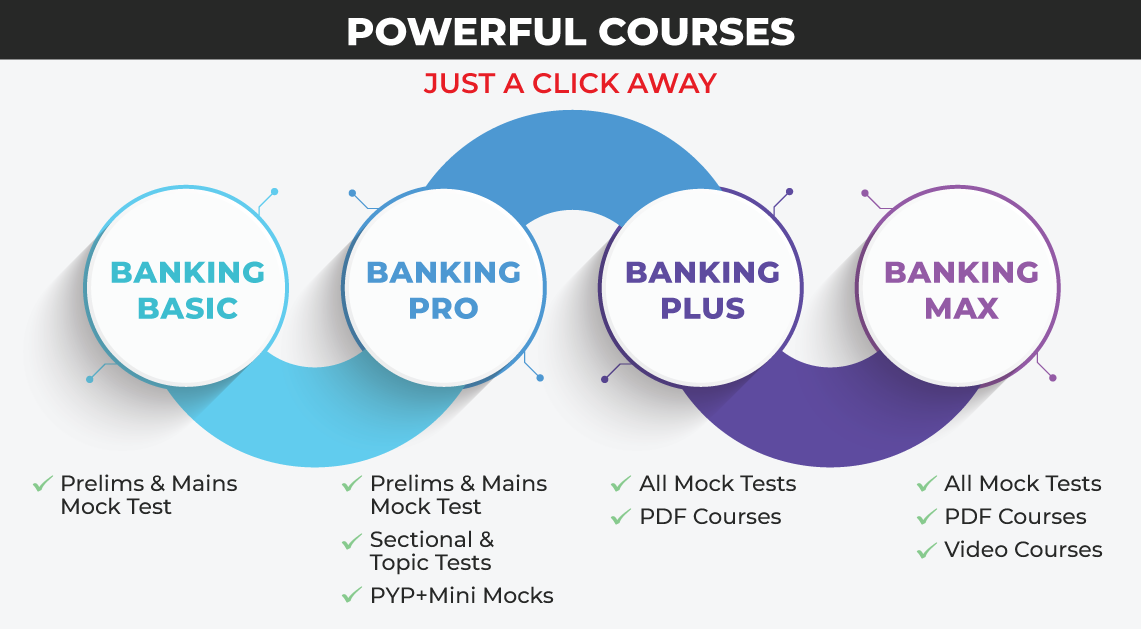

In this blog, we have given a glance at NIACL AO or LIC AAO, and tried to give a comparison to facilitate participants in choosing the exam according to their preference. To prepare for NIACL AO 2025 and LIC AAO 2025, you can subscribe to our banking and insurance courses. To practice questions and make yourself accustomed to the exam environment, you can take our mock test series. The link is given below.

Join our exclusive Telegram group where our experts are ready to answer all your queries, guide you in banking exam preparation, and give personalised tips to boost your success. Get access to real-time solutions, expert advice, and valuable resources to improve your study journey.

- Sign Up on Practicemock for Updated Current Affairs, Topic Tests and Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Stenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test