Want to get ready for the UPSC, RBI, SEBI, or NABARD exam? If yes, you have to stay updated about key economic and regulatory updates. In today’s edition of Vishleshan, we’ll discuss the Banking License to Corporate Houses. These issues are highly relevant for all the upcoming competitive exams mentioned above. Keep reading to stay ahead with a clear understanding of these current updates.

World Economic Outlook – July 2025

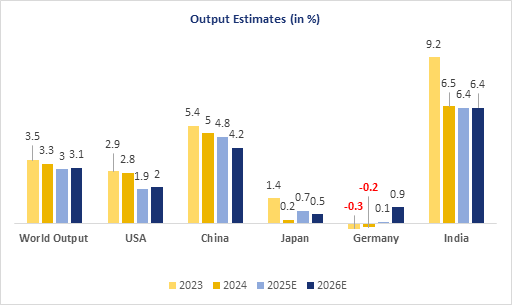

Context: The IMF expects modest improvement in global growth as financial conditions ease and fiscal support strengthens across major economies. It now expects India to grow 6.4% in both FY26 and FY27, citing resilient domestic fundamentals and a more benign global environment.

Link to the Article: Mint

The International Monetary Fund (IMF) has nudged its forecast for global growth higher, citing the resilience of large economies. However, this recovery is described as fragile and highly vulnerable to policy uncertainty and escalating trade tensions, particularly the threat of new US tariffs. The IMF also raised its growth forecast for India for FY26 and FY27, acknowledging its sustained domestic resilience and a more favourable external environment. Despite this optimism, global risks remain a significant concern for policymakers in India and worldwide.

International Monetary Fund (IMF):

Foundation: The International Monetary Fund (IMF) was founded at the Bretton Woods Conference in 1944 and began its formal existence in 1945. Its establishment was a response to the economic devastation of the Great Depression and World War II, with the goal of preventing a recurrence of such crises and fostering global economic cooperation.

Key Responsibilities and Mandates: The IMF’s primary responsibilities include:

- Fostering Global Monetary Cooperation: Promoting international monetary cooperation and exchange rate stability.

- Securing Financial Stability: A core mandate is to ensure the stability of the international financial system and prevent crises.

- Facilitating International Trade: Helping to facilitate the expansion and balanced growth of international trade, contributing to high employment and sustainable economic growth.

- Lending: Providing financial assistance to member countries that are experiencing balance of payments problems to help them stabilize their economies and restore sustainable growth.

- Surveillance: Monitoring the economic policies of its 190 member countries and providing policy advice to them.

How it Functions: The IMF is governed by and accountable to its member countries. It functions through a quota-based system, where a country’s quota determines its financial contribution, voting power, and access to financing. The IMF’s highest decision-making body is the Board of Governors, which meets annually. Daily operations are handled by an Executive Board and the Managing Director.

India’s Relation with IMF: India is a founding member of the IMF. It is one of the key emerging economies and plays a significant role in IMF discussions and governance. India’s relationship with the IMF has evolved from being a borrower in the past (notably during the 1991 balance of payments crisis) to a major contributor to the global economy and a provider of financial assistance to other nations through IMF arrangements.

IMF’s SDR Arrangement (Special Drawing Rights):

- What: The SDR is an international reserve asset created by the IMF in 1969 to supplement member countries’ official reserves. It is not a currency itself but a potential claim on the freely usable currencies of IMF members.

- Value: Its value is based on a basket of five major currencies: the U.S. dollar, the euro, the Chinese renminbi (yuan), the Japanese yen, and the British pound sterling.

- Purpose: SDRs are allocated to IMF members and can be exchanged for these currencies to help countries meet their balance of payments needs.

How IMF is Different from World Bank

The IMF and the World Bank are both Bretton Woods institutions, but they have distinct mandates and roles.

| Feature | International Monetary Fund (IMF) | World Bank |

| Primary Mandate | Focused on macroeconomic stability and financial crises. Its main goal is to maintain the stability of the global monetary system. | Focused on long-term economic development and poverty reduction. Its goal is to help developing countries build their economies. |

| Core Activity | Provides short-to-medium-term loans to countries facing balance of payments difficulties or financial crises. It acts as a global financial “firefighter.” | Provides long-term loans, grants, and technical assistance for specific development projects (e.g., infrastructure, education, health) in developing countries. |

| Funding Source | Funded by member country quotas and a small amount of borrowed funds. | Funded through contributions from member states and by borrowing on international capital markets (using its high credit rating). |

| Loan Conditions | Loans are often attached to strict conditions (conditionalities) that require borrowing countries to undertake specific policy reforms (e.g., fiscal discipline, monetary tightening). | Loans are generally tied to the implementation of specific development projects and policy reforms to ensure the project’s success. |

| Focus | Deals with a country’s macroeconomic policies, including fiscal policy, monetary policy, and exchange rates. | Deals with a country’s structural policies, such as governance, health, education, and infrastructure. |

| Target | Its primary audience is government treasuries and central banks. | Its primary audience is governments of developing countries for project financing. |

Analysis of the Article: Decoding the Global and Indian Economic Outlook

The article details the IMF’s latest economic projections, highlighting a cautiously optimistic global outlook while also underscoring significant risks. India’s economic performance stands out as a beacon of resilience amid these global uncertainties.

1. IMF’s Global Economic Outlook and Risks:

- Upward Revision in Global Growth: The IMF has nudged its forecast for global growth higher, projecting the world economy may expand by 3% in 2025 and 3.1% in 2026. This is an upward revision from its April forecast.

- Key Risks Flagged: The recovery, however, remains “vulnerable to policy uncertainty and trade tensions”.

- US Tariffs: The IMF warned that if US tariffs rise again after 1 August without new agreements, “global output could shrink, exposing the fragile nature of the recovery”.

- Trade Uncertainty and Geopolitical Tensions: IMF chief economist Pierre-Olivier Gourinchas flagged “mounting risks from escalating trade tensions,” stating that “persistent trade uncertainty is dampening investment” and a “fragile geopolitical environment could spark fresh supply disruptions”.

- Debt and Fiscal Deficits: Gourinchas also warned that “elevated debt and deficits, coupled with threats to central bank independence, heighten vulnerabilities”. He stressed the need for “gradual and credible fiscal consolidation”.

Source: World Economic Outlook – July 2025

2. India’s Economic Resilience and Growth Forecasts:

- Upward Revision for India: The IMF raised its growth forecast for India to 6.4% for FY26, up from 6.2%, and revised its FY27 projection to the same level. It maintained its FY25 growth estimate at 6.5%.

- Sources of Resilience: The IMF cited “sustained domestic resilience and a more favourable external backdrop”. The RBI’s State of the Economy report also said India’s economy “remains resilient, with key sectors maintaining momentum”.

- Public Capex as Growth Engine: With private investment still lagging, “public capital expenditure, especially by the Centre, remains the key engine of growth”. The FY26 Union Budget allocated ₹11.21 trillion for central capex (about 3.1% of GDP), a nearly 10% increase from the previous year’s revised estimate.

- Monetary and Fiscal Policy Support:

- Monetary Policy: With inflation softening, the RBI has cut policy rates three times in 2025, bringing the repo rate down by 100 basis points from 6.50% to 5.50%, a clear pivot towards an accommodative stance. A “better-than-normal monsoon is cooling food inflation”. Headline CPI inflation eased to a 77-month low of 2.10% in June, with food inflation turning negative.

- Fiscal Policy: Expectations of GST tweaks, income tax relief, and other supportive policy measures in the second half of the fiscal year are mentioned to stimulate consumption and investment.

3. Comparison with other Forecasts:

- RBI: Projected 6.7% GDP growth for FY26 in February 2025, but trimmed it to 6.5% in April due to rising trade risks.

- Moody’s Ratings and S&P Global: Both expect FY26 growth at the same 6.5% level.

- Asian Development Bank (ADB): Pared back its forecast to 6.5% from 6.7%, flagging rising US tariffs and trade risks.

- Union Finance Ministry (Economic Survey FY25): Pegged FY26 growth at 6.3-6.8%, reflecting cautious optimism.

4. Global Comparisons:

- The IMF’s latest upward revisions also apply to major global economies:

- US: Expected to grow by 1.9% in 2025 and 2% in 2026.

- China: Forecast has been sharply revised up to 4.8% in 2025 and 4.2% in 2026.

- Euro Area: Projected to expand by 1% in 2025 and 1.2% in 2026.

In conclusion, the IMF’s upward revision of global growth forecasts is a positive sign, but it comes with a strong warning about the fragility of the recovery in the face of geopolitical and trade uncertainties. India, with its resilient domestic economy, supportive monetary and fiscal policies, and a cooling inflation environment, is well-positioned to sustain its growth momentum. However, the external headwinds and risks to trade flows remain a concern, necessitating continued vigilance and a focus on long-term productivity through structural reforms.

- Sign Up on Practicemock for Updated Current Affairs, Topic Tests and Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Stenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test